The government shutdown gives renewed relevance to this 4-part series I wrote for Wise Bread at the peak of the financial crisis: Getting by without a job, part 1–losing a job

Tag: Economics

The luxury of ownership

Being a member of the Winfield Village Cooperative, I’m technically a home owner and not a renter. In fact, more then technically: I’m actually a home owner.

On a day-to-day basis, living at Winfield Village is a lot like being a renter. I pay a monthly housing charge that feels a lot like a rent payment when I pay it. There’s an office staff that shows units to prospective new owners, and a maintenance staff to fix things (plumbing, appliances, etc.), and keep up the grounds—all very similar to what you could expect at an apartment. But there are differences, and most of the differences are luxuries.

There are a few differences that are financial. For example, I’m entitled to deduct my share of the property taxes and mortgage interest that Winfield Village pays.

One that I hadn’t thought of before was made especially apparent to me a few weeks ago, when a friend mentioned having to sign the next-year’s lease for his apartment, and I was reminded what an annoyance that always was.

Every year when we used to live at Country Fair, we’d get a call from the office asking if we wanted to renew our lease for the following year. Every year the rent went up a little, which was just to be expected.

More annoying was that every year we had to read the new lease. Most years it was the same or nearly the same—the office staff would go through and indicate changes—but we still felt like we ought to read it, because we’d still be agreeing to any changes that the office staff failed to point out. I think twice there was a complete re-drafting of the lease, so we had to read it all the more carefully.

Even years when it was still (mostly) the same, after we read it we then had to go through the whole thing with the office staff, because there were a dozen places we had to initial specific provisions, and then we had to sign three originals.

Although it was just an off-hand comment, my friend mentioning his lease re-signing brought up a whole bunch of stressful memories, such as deciding how to deal with the provisions that were so badly drafted as to require us to do preposterous things. (One I remember was a provision intended to reduce the chance of pipes freezing that seemed to require that we leave a trickle of water running anytime the temperature was below freezing, which would basically be all winter here in lovely central Illinois.)

There are other ways in which we are owners. We can repaint. We can buy our own appliances, or make other upgrades to our kitchen. (But we don’t have to. If our stove or refrigerator fails, maintenance will come fix it, or replace it if necessary.)

Until my friend brought it up, it hadn’t occurred to me that I haven’t had to go through the whole stressful lease-signing process for three years now! Instead of a lease, I have an occupancy agreement. That agreement hasn’t changed in three years, so I haven’t needed to re-sign. The housing charge hasn’t gone up either. And because it’s a co-op, I’ll have a vote on any major changes that do come up.

Ah, the luxury of ownership.

Losing a job

My friend Mart lost her job this week.

I know all about losing a job. Over the years I was fired or laid off four times.

Getting laid off is humiliating and insulting. The process is stressful and and unpleasant. The aftermath, where you have to deal with your feelings about the fact that other people kept their jobs while you lost yours, at the same time that you deal with having a sharply lower income, layers more stress and unpleasantness on top of that.

Losing a job is also frightening. It fills your future with unknowns.

The middle time I was laid off, my former employer hired an expensive outplacement firm to help us make the transition. We had a series of meetings at an off-site location where a counselor gave us advice on dealing with the emotional and practical issues. Although the somewhat simplistic advice was another layer of insult piled on top of the insult of being let go, it was actually pretty well done. I used what I learned there for pep talks that I’d give former coworkers when they were let go. I used it as the basis for part 1 (losing a job) of the Wise Bread series I wrote on getting by without a job.

These last few decades—as the whole economy has adjusted to eliminate the working-class jobs that used to provide a middle-class standard of living—losing a job has become even worse than it was back when I lost mine. And yet, while losing a job is a pretty bad thing, but it’s not always purely bad. Even people who love their job don’t love everything about it. (Mart in particular, I think, loved books a lot more than she loved her job at a bookstore.)

Still, losing a job sucks, even if things go as well as possible after that.

Visit Mart’s website! Consider buying her book!

Busy writing

Because it was so precisely in my wheelhouse, I simply had to submit a story for the Universal Basic Income short story contest Into the Black.

I plugged away at a story most of October. In particular, I worked on it three different times with Elizabeth Shack’s Thursday writing group. And I got a story nearly finished, except it refused to turn into a basic income story.

Finally, about three days ago I gave up trying to twist that story into a basic income story and sat down to write another—even though I only had four or five days until the submission deadline.

It reminded me of Clarion in a way—sitting down at my computer, determined to get a story done in less than a week. At Clarion the motivation was simply that if you didn’t get a story done each week you’d miss out on the chance to get a story critiqued by that week’s instructor, but it was enough. And this made for a similarly strong motivation.

And I’m pleased to report success: I finished a draft on Saturday. On Sunday I read through it and made minor edits and gave it to a couple of first readers. Today I made another pass through it, making changes suggested by my reader’s comments, and then submitted it to the contest.

That was all fun and good, but there is yet more good.

First, the story that would not be a basic income story is nevertheless a perfectly good story. I’ll let it sit for a bit, then go through and remove the failed attempts to twist it into one, and then take a go at finishing it on its own terms. I’m hopeful.

Second, there’s also a fragment of that story that I pulled out and stashed that might well turn into another story. It was part of one effort to twist the story, but it’s really a pretty good idea in its own right, and might make for a whole story all on its own.

So I come out of this with one finished story, one mostly-written story, and a few fragments of a possible third story. Go me!

I am also reminded that I have a couple of finished, critiqued stories that only need a rewrite pass to be ready to submit to markets, which I have been woefully lax about submitting. (My Clarion instructors would be appalled.)

So, with a little luck, in a matter of days I might well have five stories out to markets. Well, not luck exactly: Diligence and persistence are what’s called for.

Short story contest I can’t skip

Even though I have several other things going on, it’s indisputable that I’m going to have to write something for this short story contest. I simply can’t imagine a theme that hits more squarely in the sweet spot of what I’m interested in: Into the Black.

In 5,000 words or less, we want you to explore the impacts of a basic income on individual lives and on society at large.

If it’s your sort of thing, you should probably write a story too. Pay is good, even if don’t win the grand prize ($12,000 paid as $1,000 a month for a year).

Student debt, which survives

Student debt, which survives even bankruptcy, is especially pernicious; one area ripe for reform is debt servicing. https://www.washingtonpost.com/news/posteverything/wp/2017/09/08/how-states-could-end-the-student-debt-collections-trap/

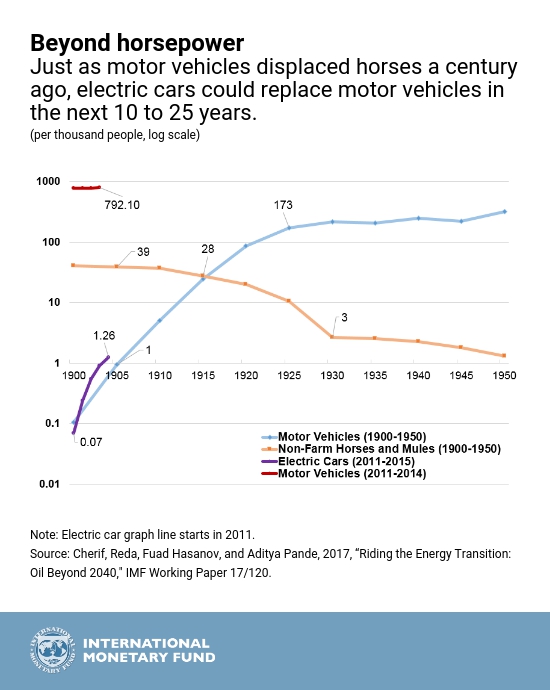

Chart of the Week: Electric Takeover in Transportation

From the IMF blog, a great chart showing the rate at which motor vehicles took over from horses early in the 20th century. Putting current motor-vehicle and electric-car use on the same graph makes a pretty good visual case that we might be as little as 15 years from the cross-over point where half the vehicles on the road are electric.

Greater affordability of electric vehicles will likely steer us away from our current sources of energy for transportation, and toward more environmentally friendly technology. And that can happen sooner than you think.

Source: Chart of the Week: Electric Takeover in Transportation | IMF Blog

If the middle class sides with the poor

If the middle class sides with the poor, almost everything they do also helps the middle class. http://www.ianwelsh.net/a-middle-class-which-aligns-with-the-rich-cuts-its-own-throat/

The Federal Reserve and the “gig” economy

The “gig” economy: all the sorts of work arrangements where you’re not a permanent employee and can’t expect that work one day implies that you’ll have work the next day—freelancing, contracting, temp work, casual labor, and most recently, software-mediated contract work like Uber driver.

These sorts of work have been growing as a fraction of all work. In fact, according to the Bureau of Labor Statistics, in the last ten years contingent workers have gone from being 10% of the workforce to being 16%. In fact,

all of the net growth in aggregate employment in the decade leading up to 2015 can be accounted for by contingent work arrangements, which means there has been no net employment growth in traditional work arrangements.

Source: FRB: Brainard, The “Gig” Economy: Implications of the Growth of Contingent Work

This matters to everyone with an interest in the U.S. economy, but it matters particularly to the Federal Reserve, which is charged by Congress to:

promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.

Source: The Federal Reserve’s Dual Mandate

So this raises the question: Does strong growth in the number of freelancers, on-call temps, and Uber drivers mean that we’re getting closer to maximum employment? Or, that we’re getting further away?

Second passports for expensive

This sort of thing was a fantasy of mine, back in the 1980s. I could see things getting worse in the US, and the idea that a foreign passport and foreign residency could provide an escape if things got too bad was pretty appealing.

Nowadays not so much. It’s not that things have gotten better in the US; it’s that things have gotten worse other places at least as quickly. More to the point, things getting worse in the US seems to make things worse other places, so the conditions that make the idea appealing are the same conditions that make it pointless.

One book that substantially influenced my thinking in this area is Emergency: This book will save your life by Neil Strauss. I recommend it highly. In entertaining and informative prose, he documents his transformation from just the sort of kook I was in the 1980s into somebody with a much more practical perspective.

Still, an EU passport might have its upsides. Anybody got a spare quarter million euros and an interest in learning Greek? (If money is no object, a half million euros will let you buy in to Ireland, and I expect learning Gaelic is optional.)

Graphic from Citizenship for Sale on the International Monetary Fund’s IMFDirect blog.